1. DCTAG Terms

1. DCTAG Terms

Academic year: Annual period during which a student attends and receives formal instruction at a college or university; typically, from August or September to May or June.

Accredited: Official recognition that a college or university meets the standards of a regional or national accreditation association.

Credits: Units that a school uses to indicate that a student has completed and passed courses that are required for a degree.

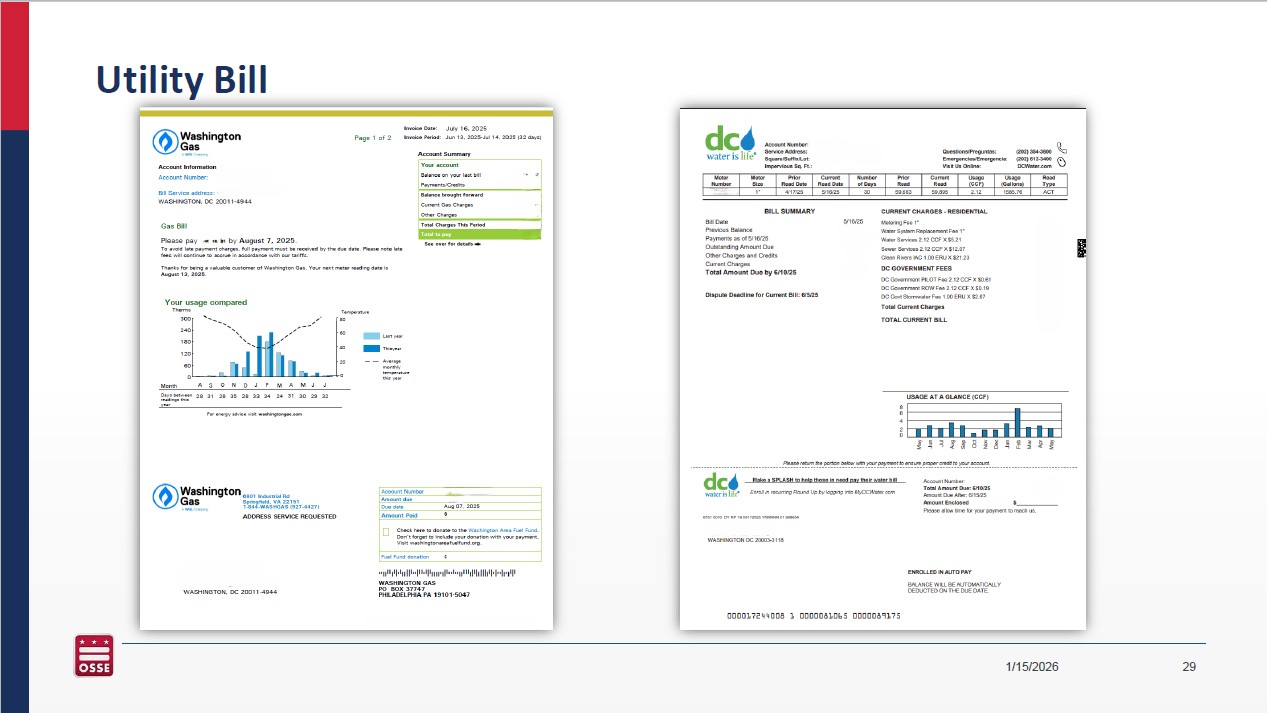

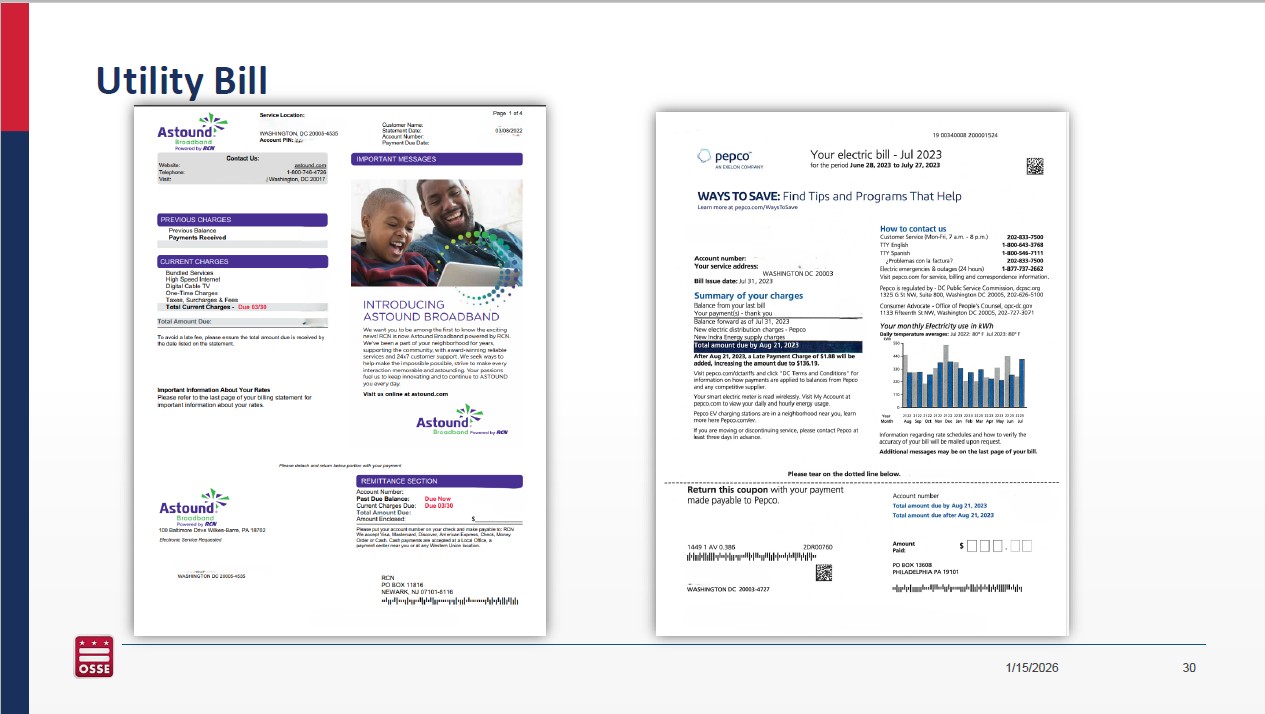

Notarized: Official fraud-deterrent process that assures the parties of a transaction that a document is authentic and can be trusted.

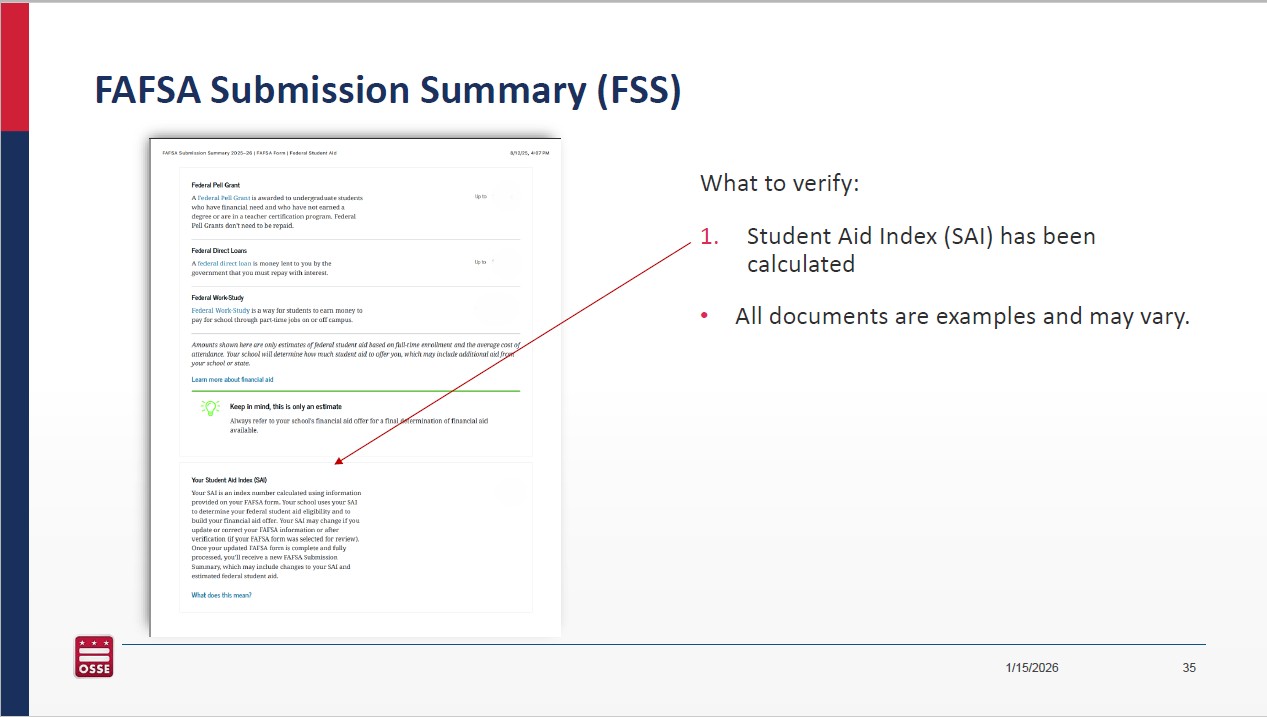

Student Aid Index (SAI): The FAFSA calculated numbers that determine Federal Student Aid (FSA) eligibility that was formerly known as Estimated Family Contribution (EFC).

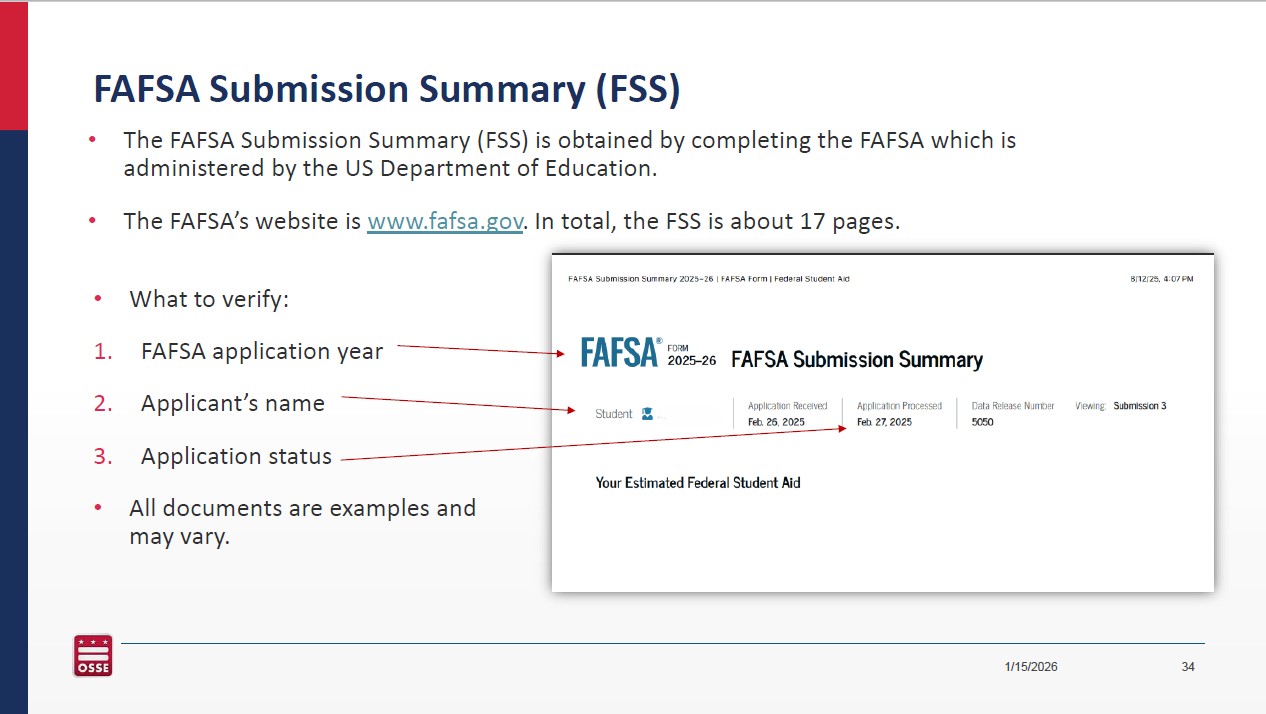

FAFSA Submission Summary (FSS): The official FAFSA application results formally known as the Student Aid Report (SAR).

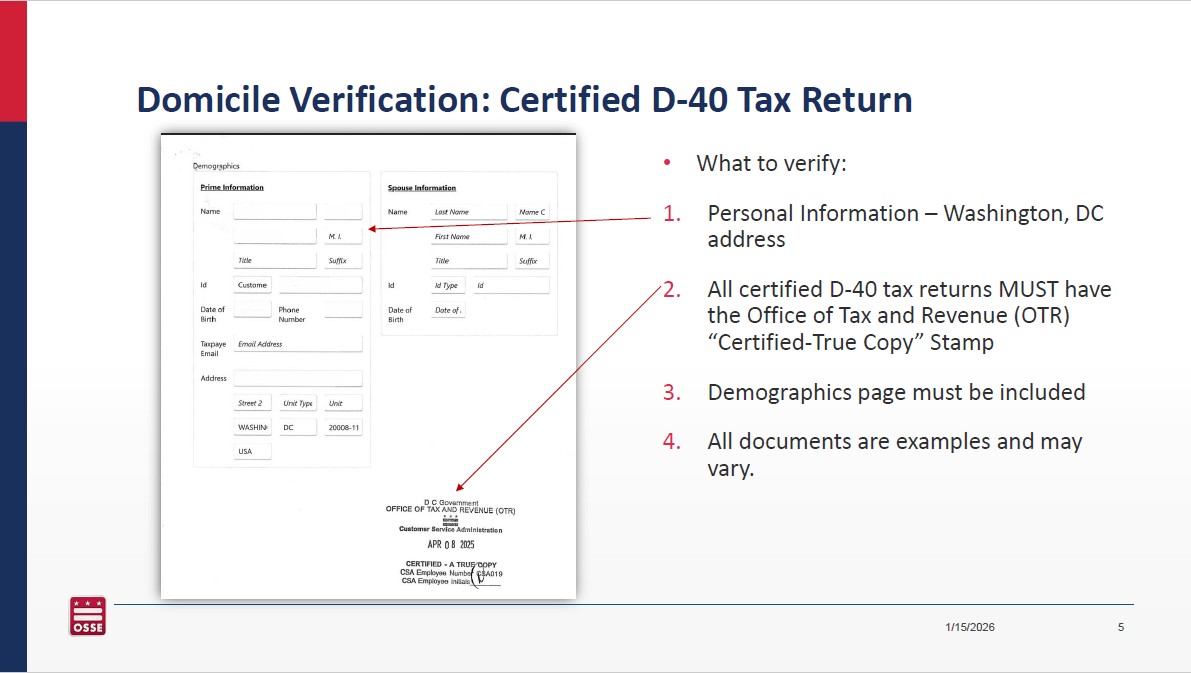

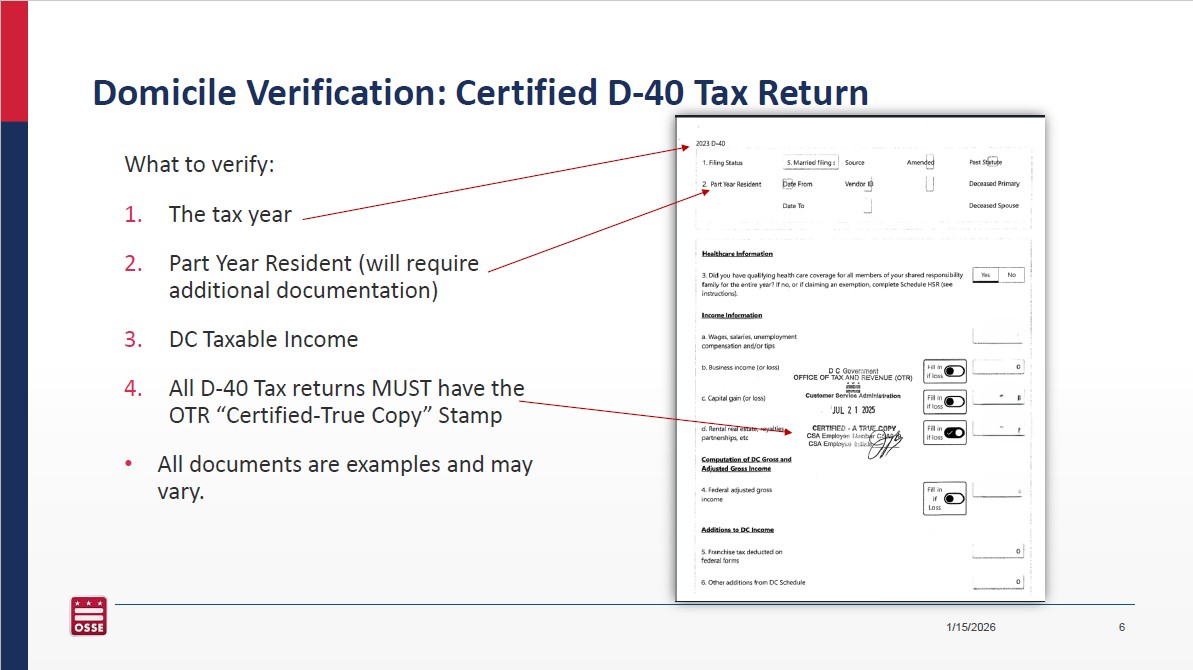

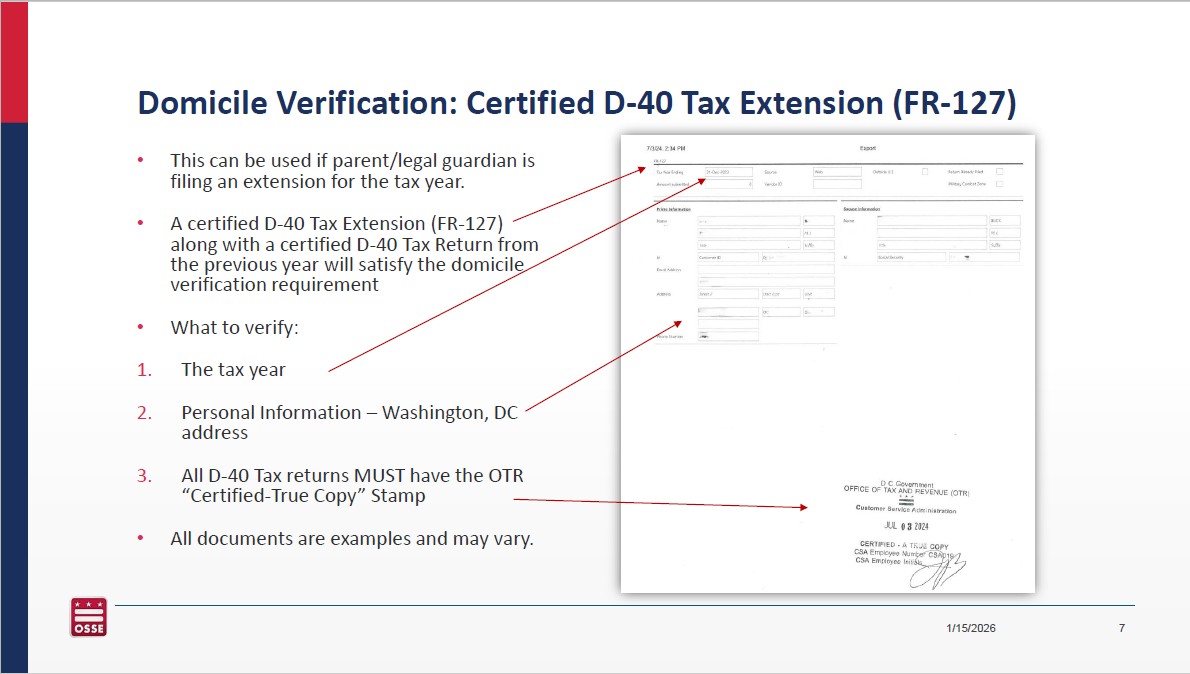

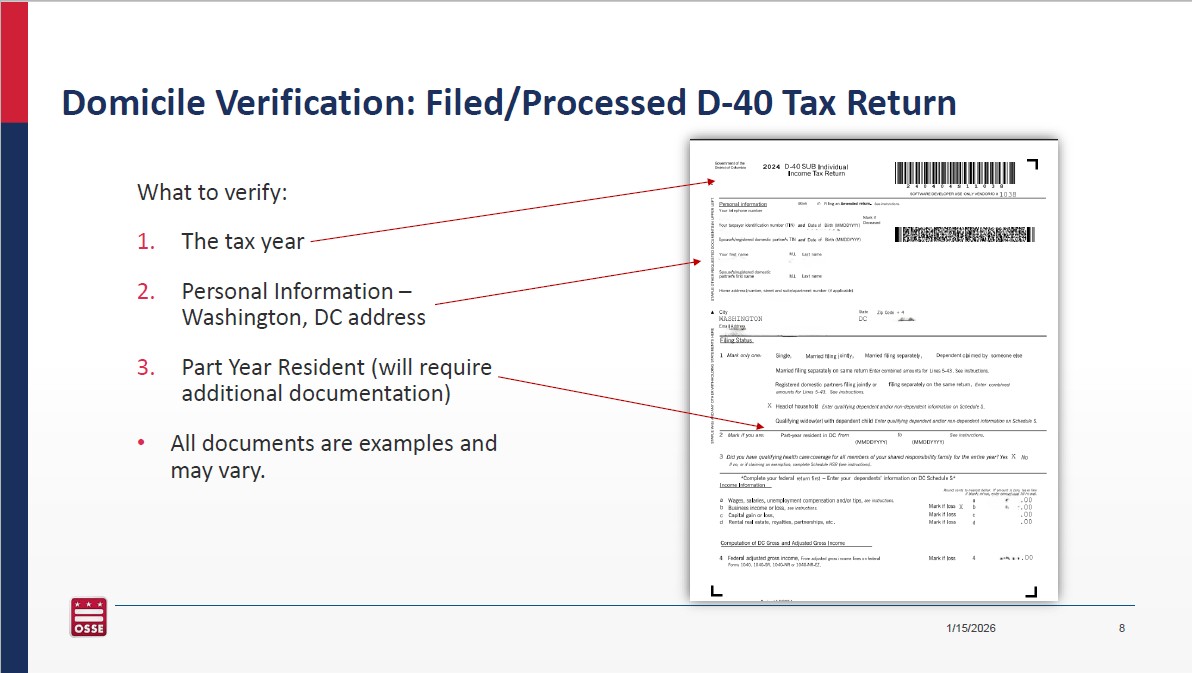

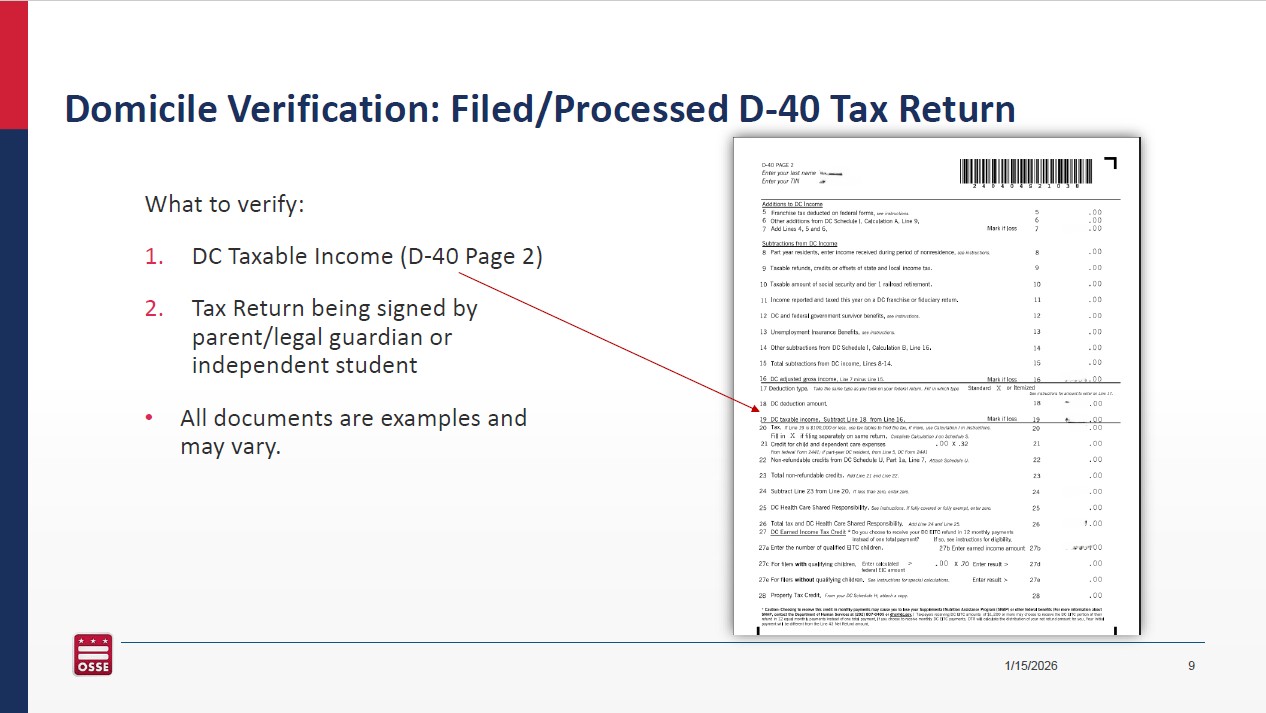

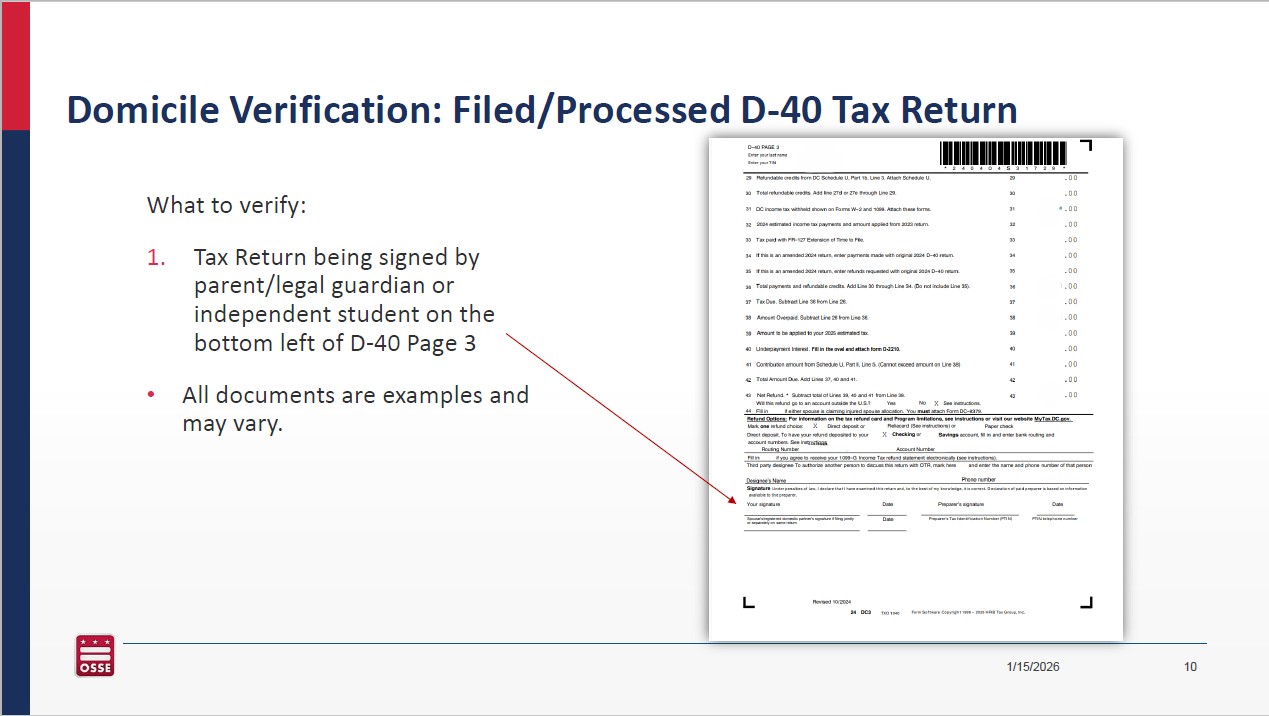

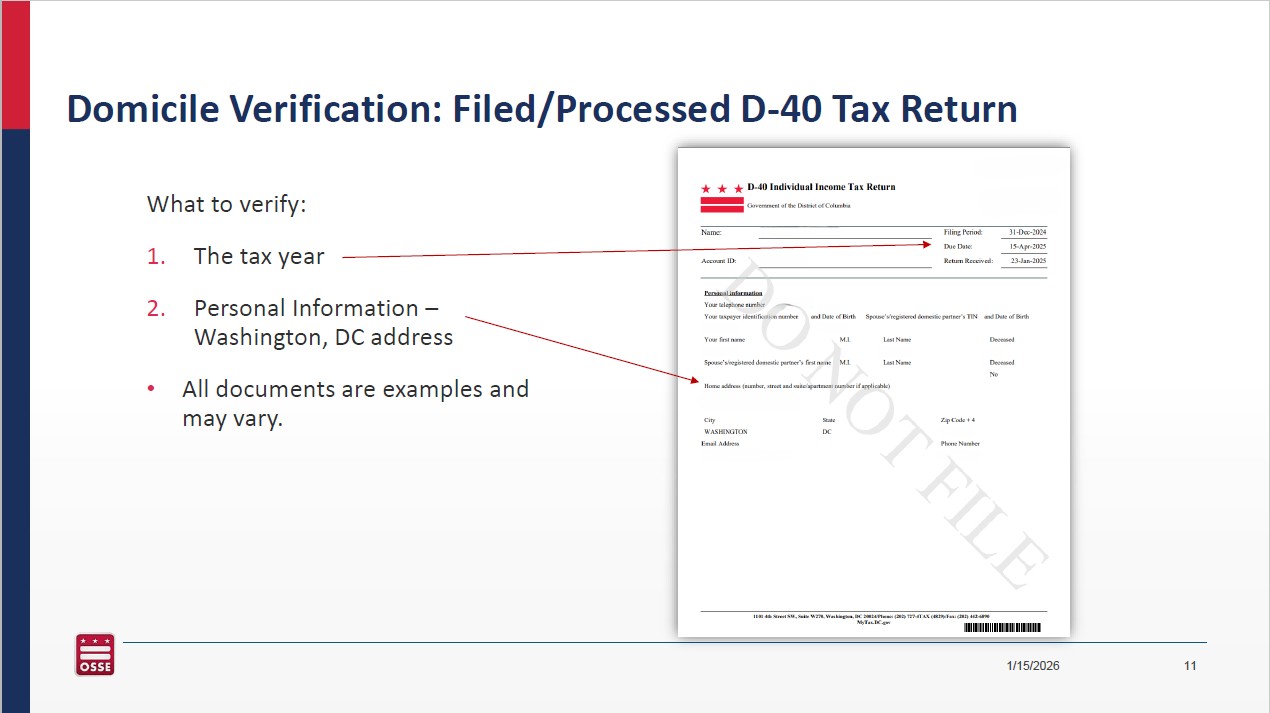

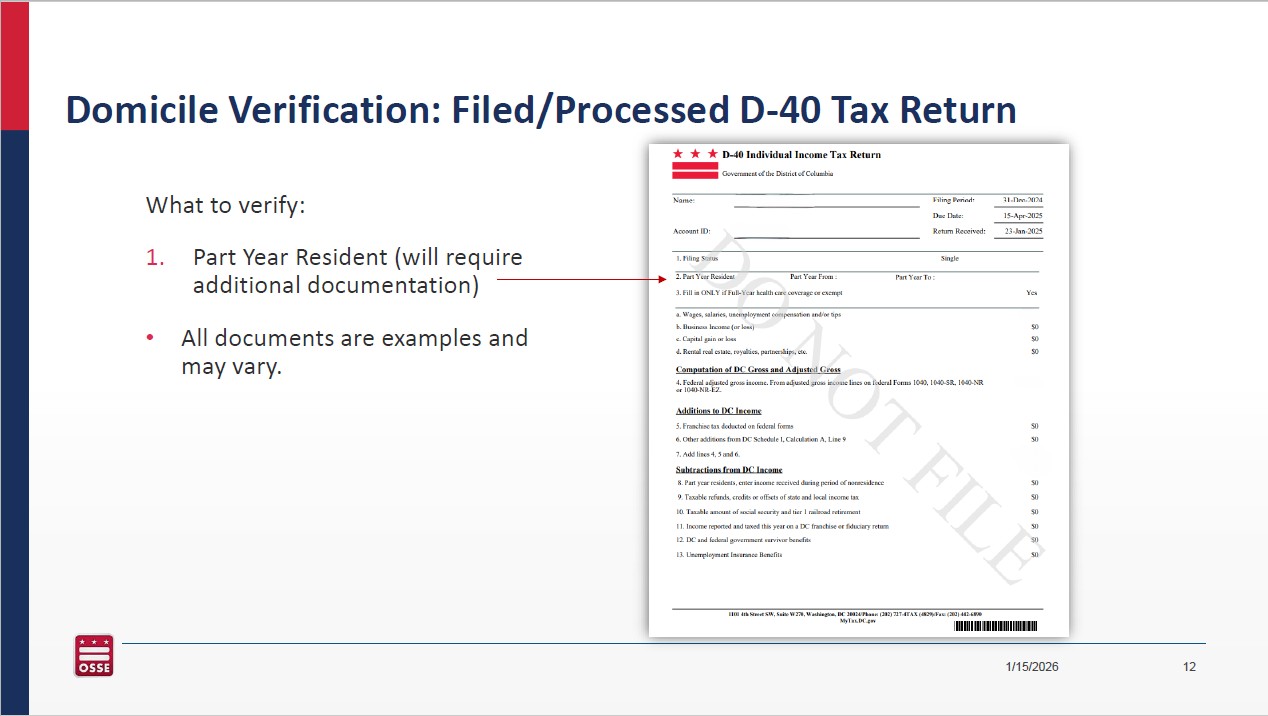

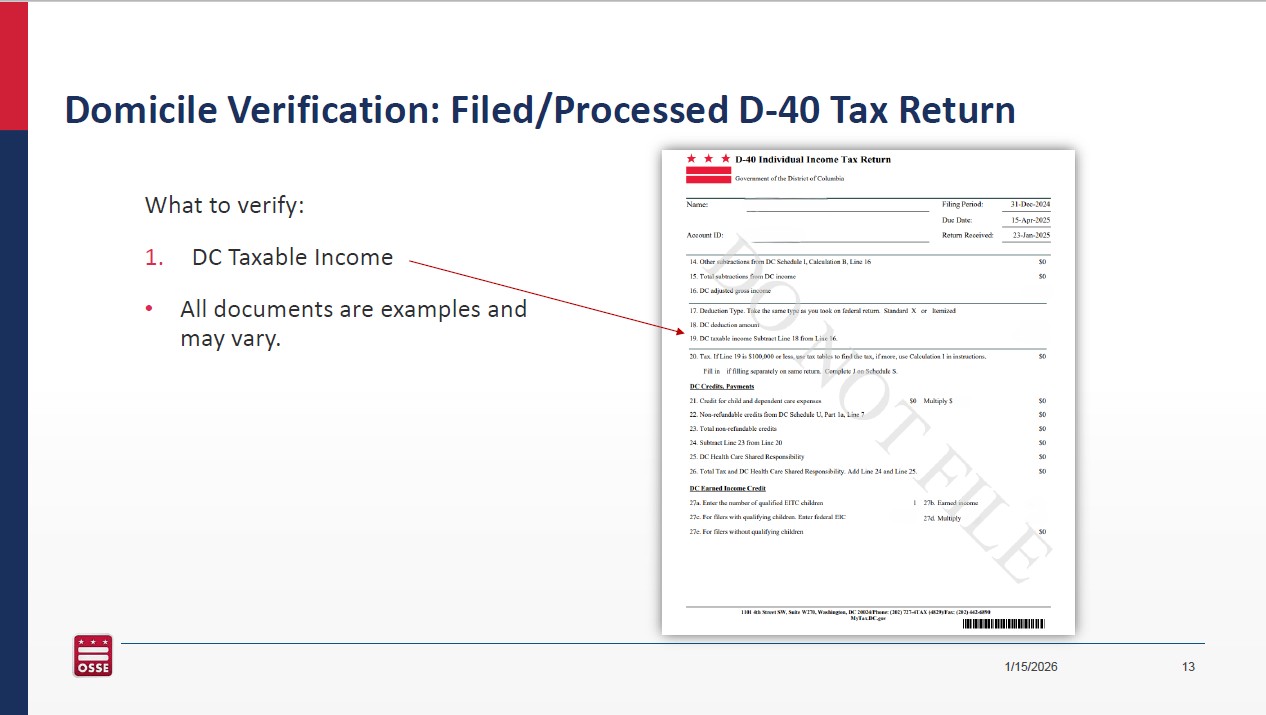

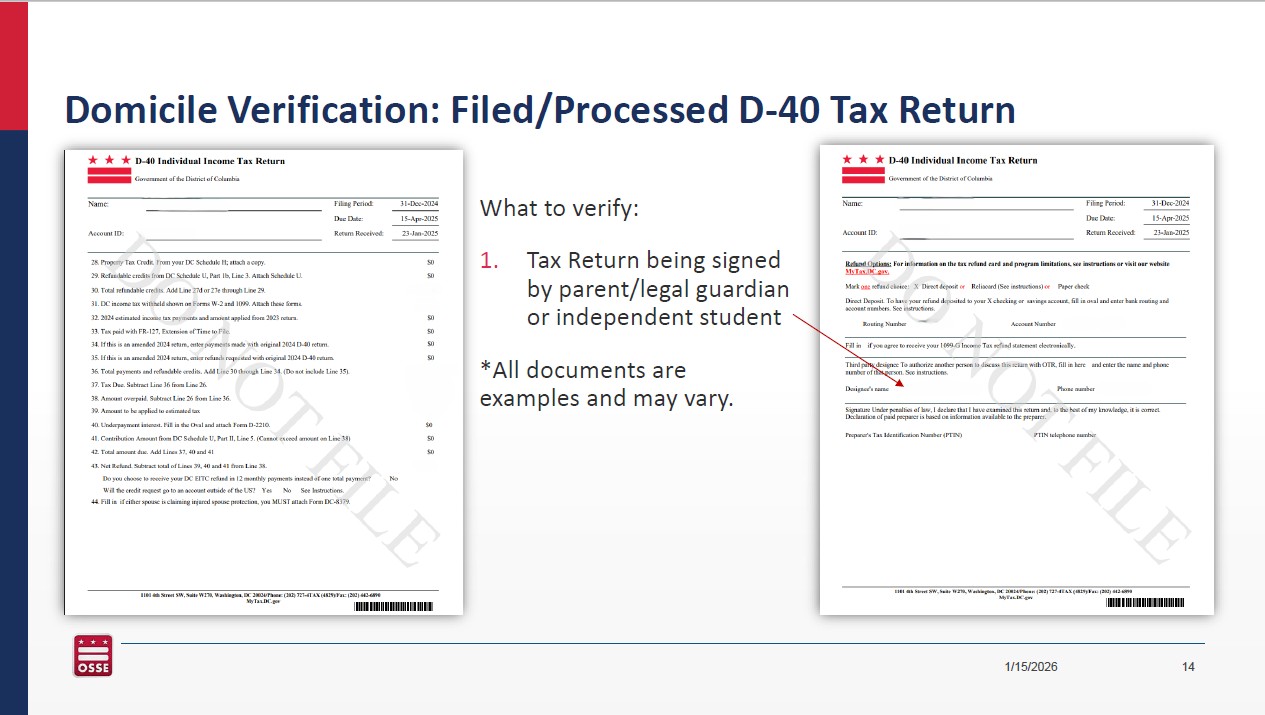

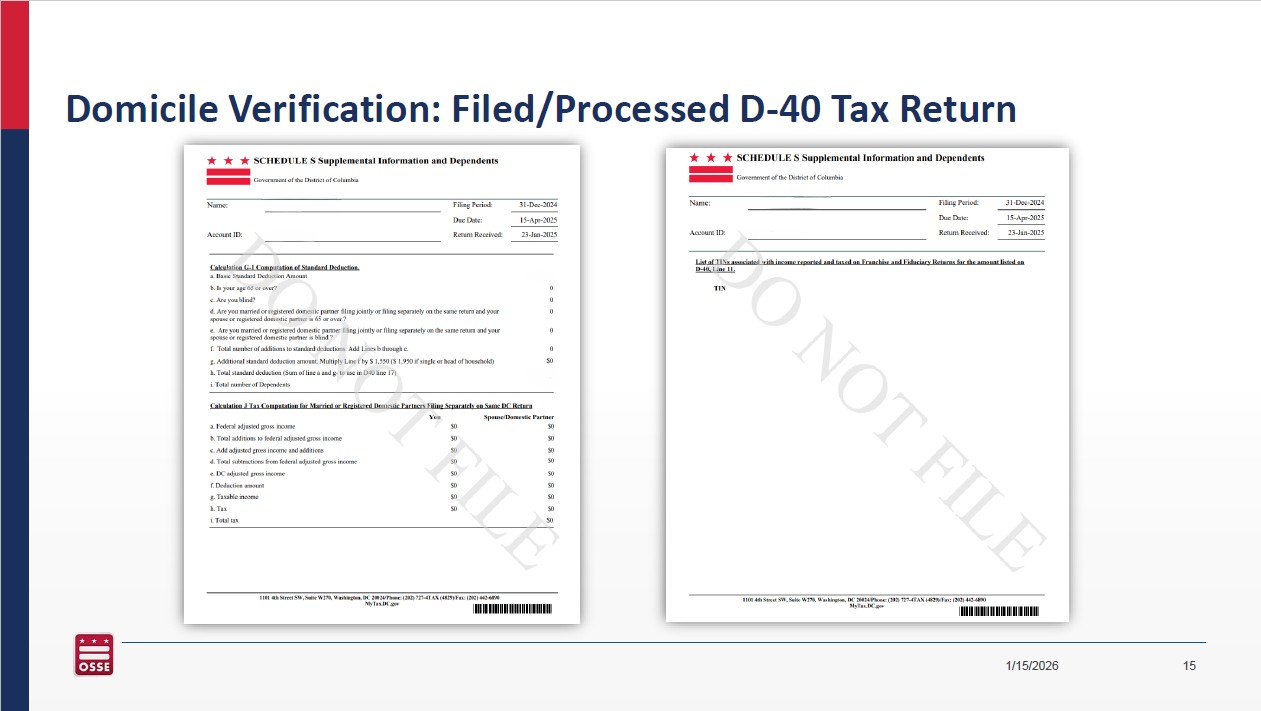

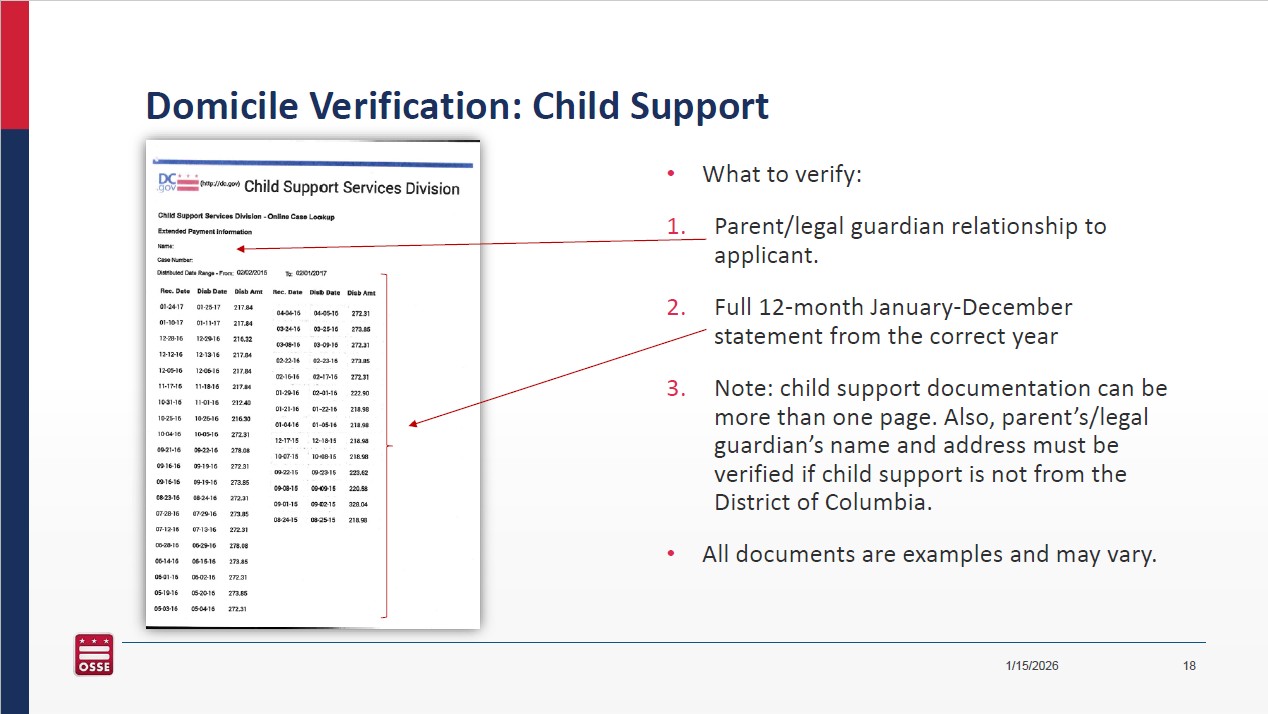

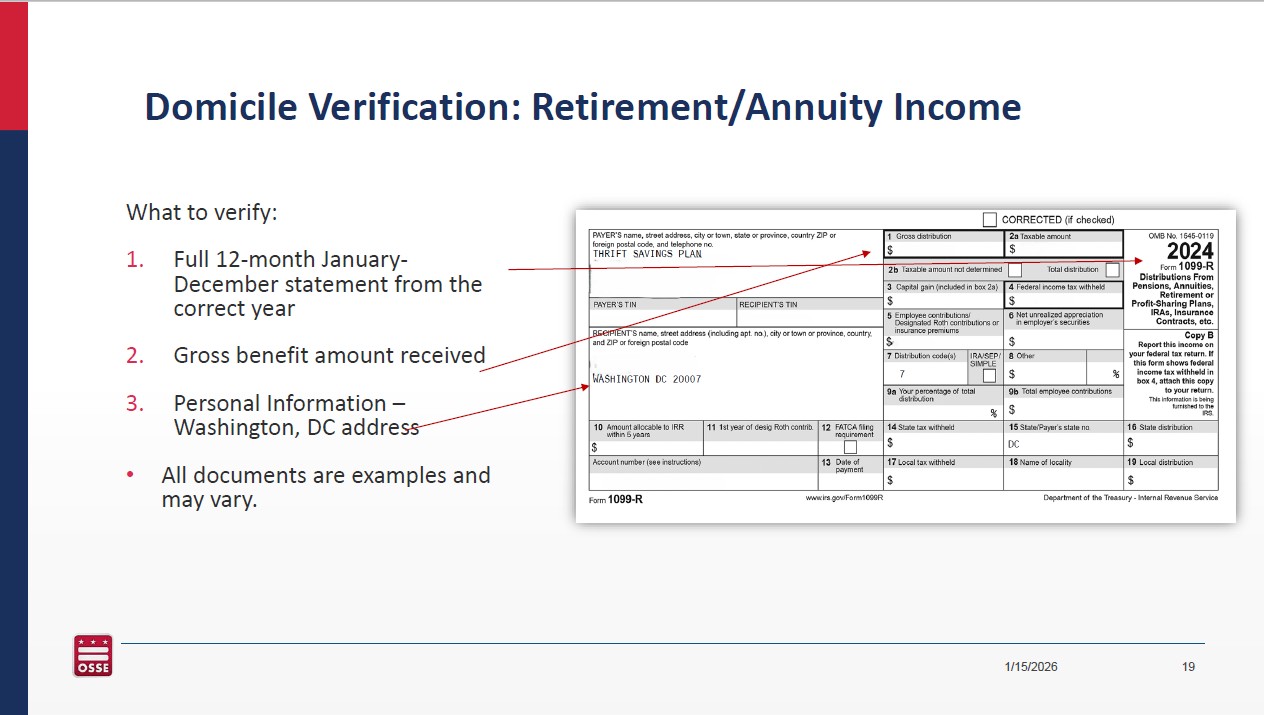

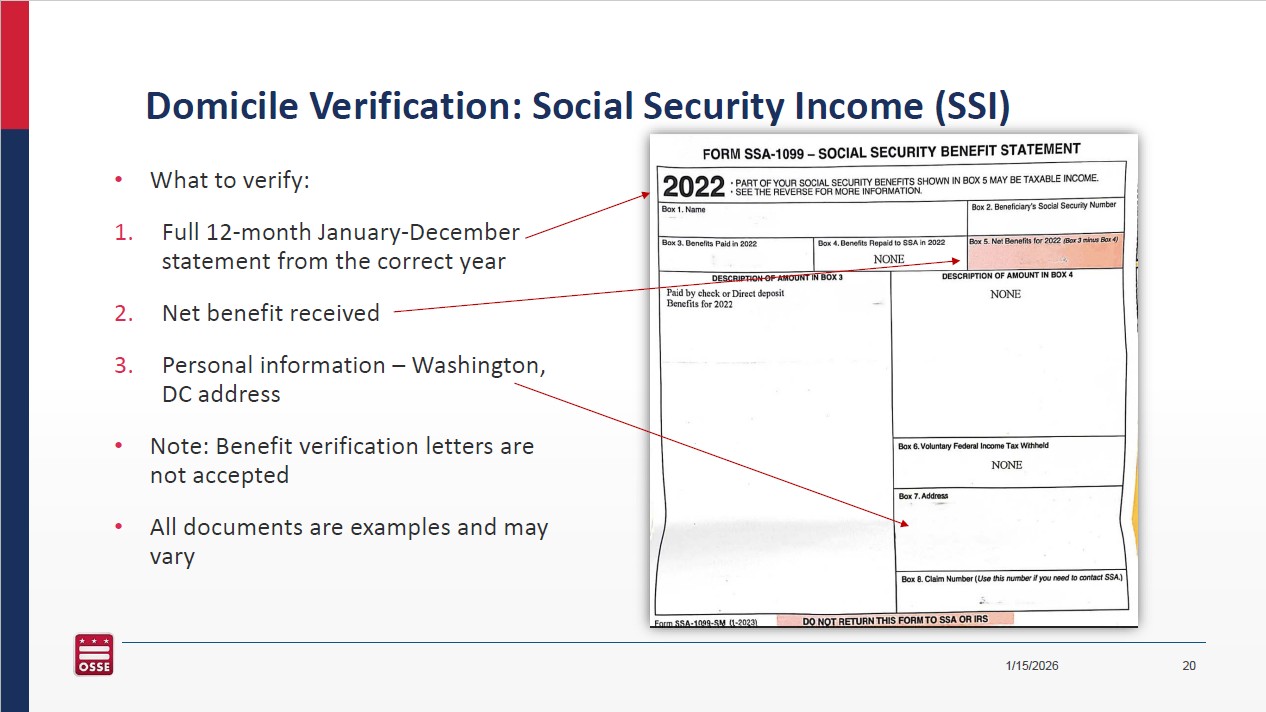

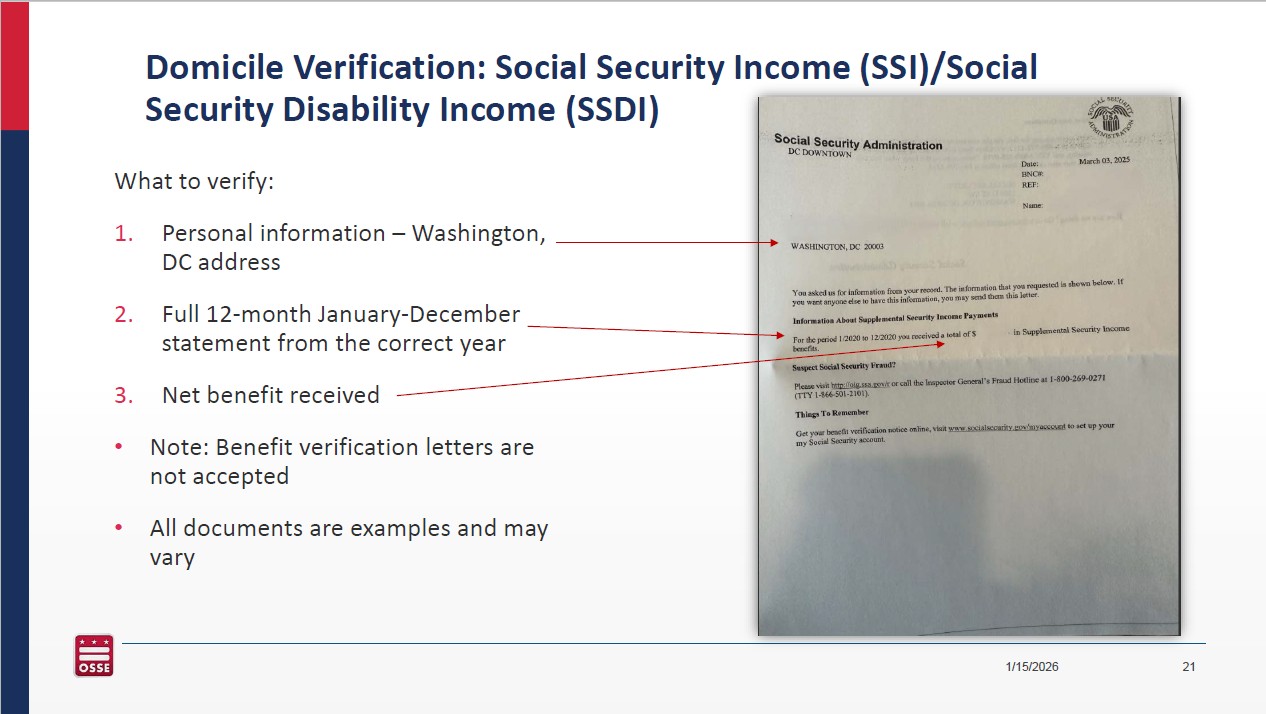

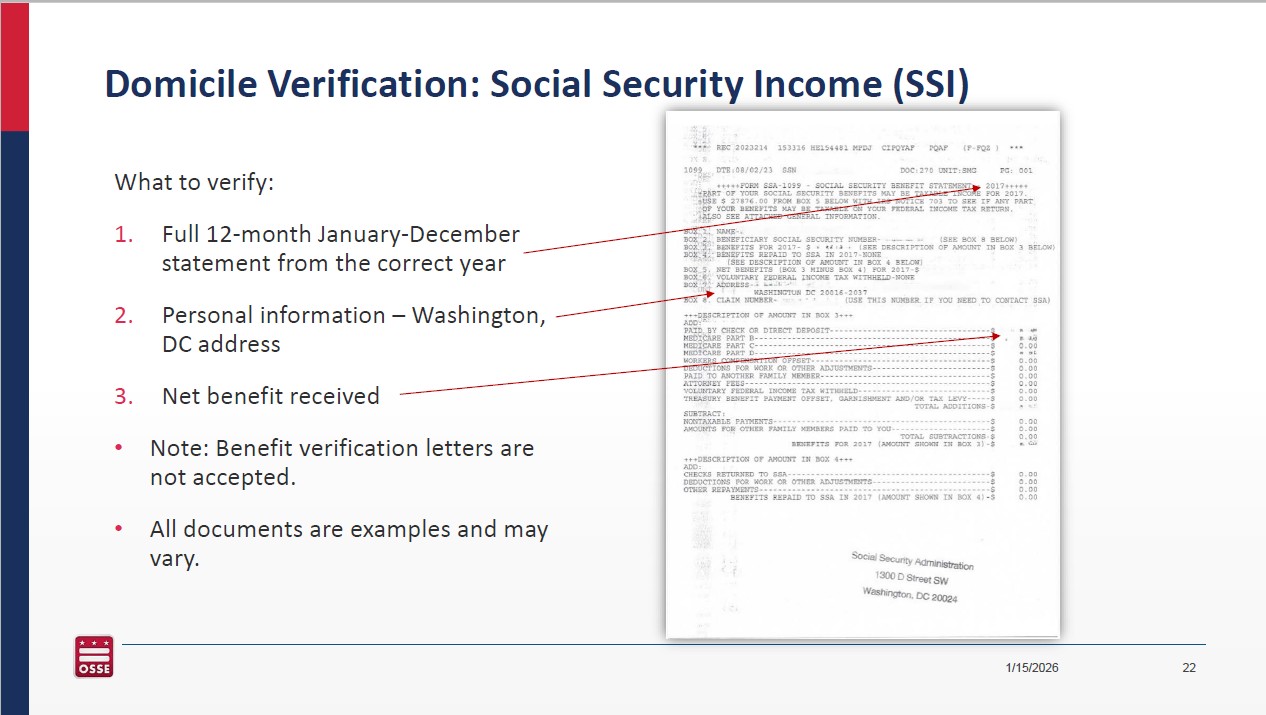

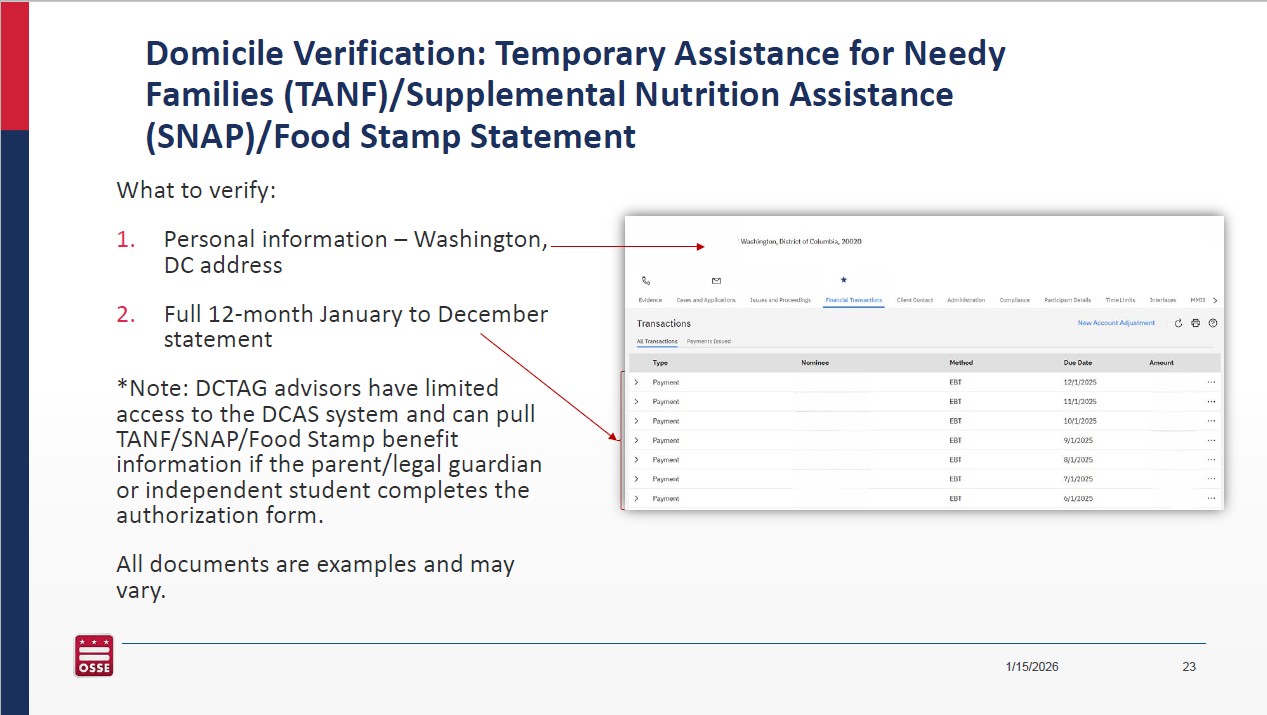

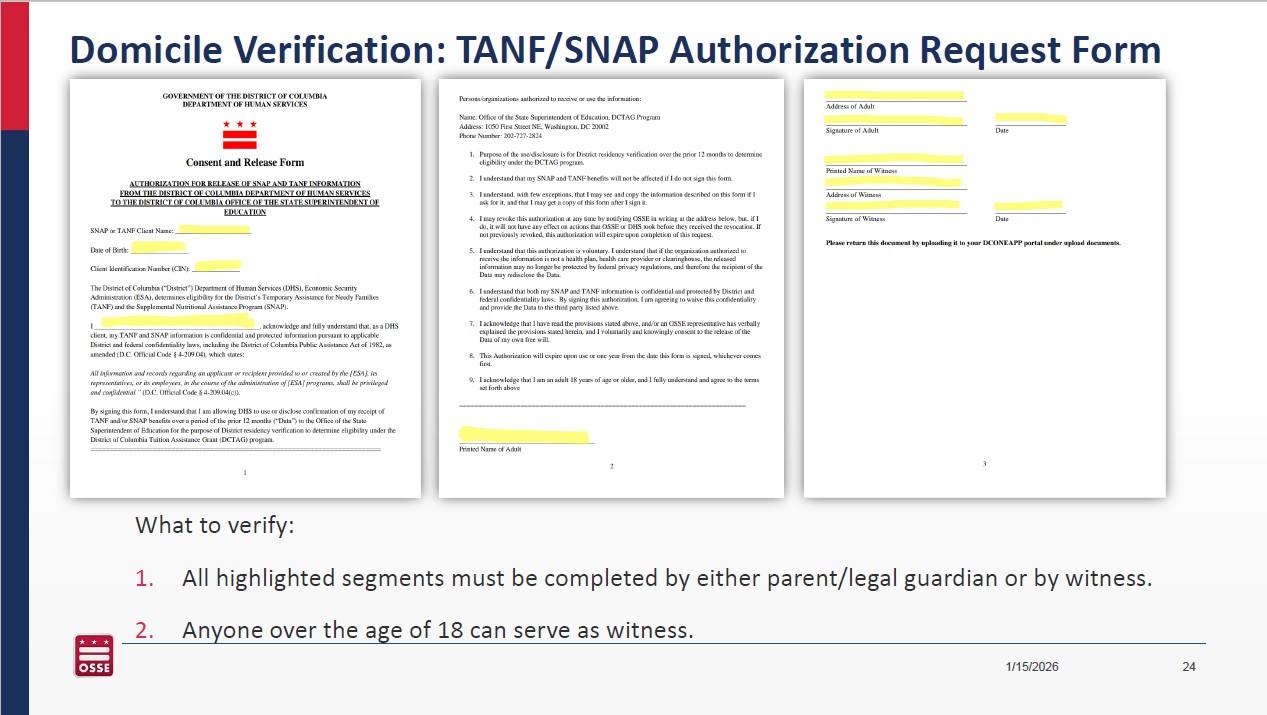

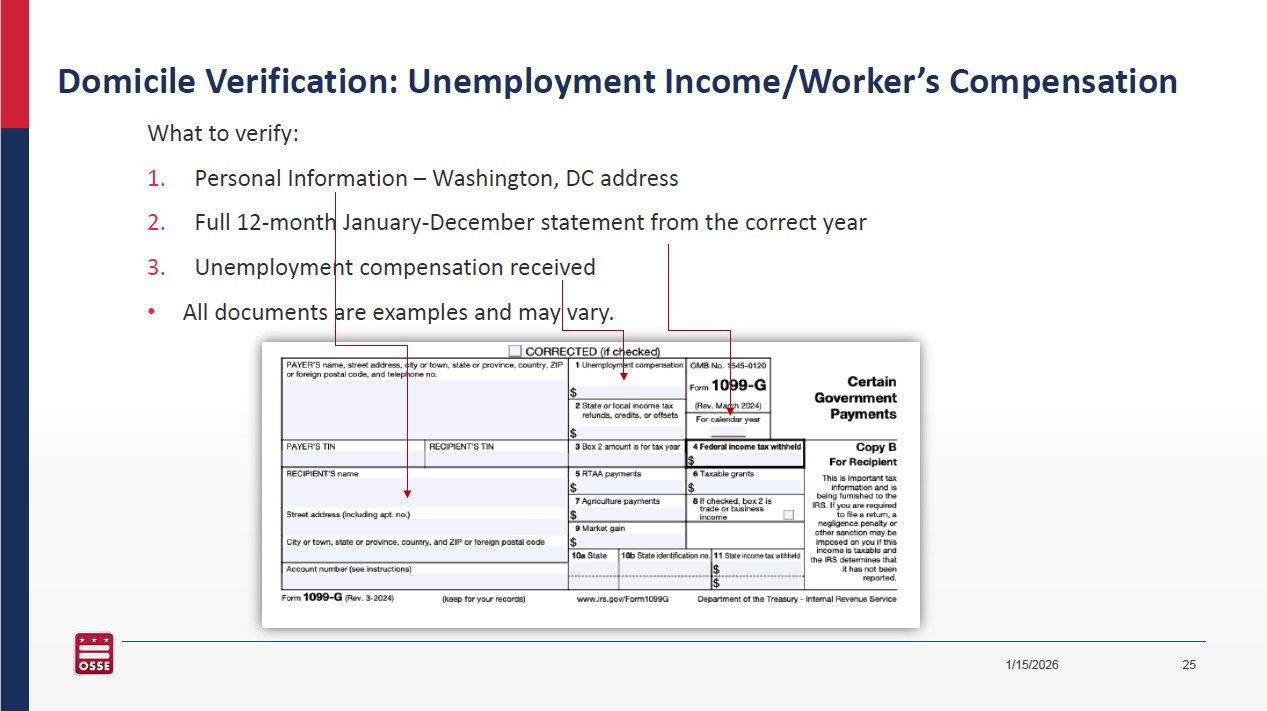

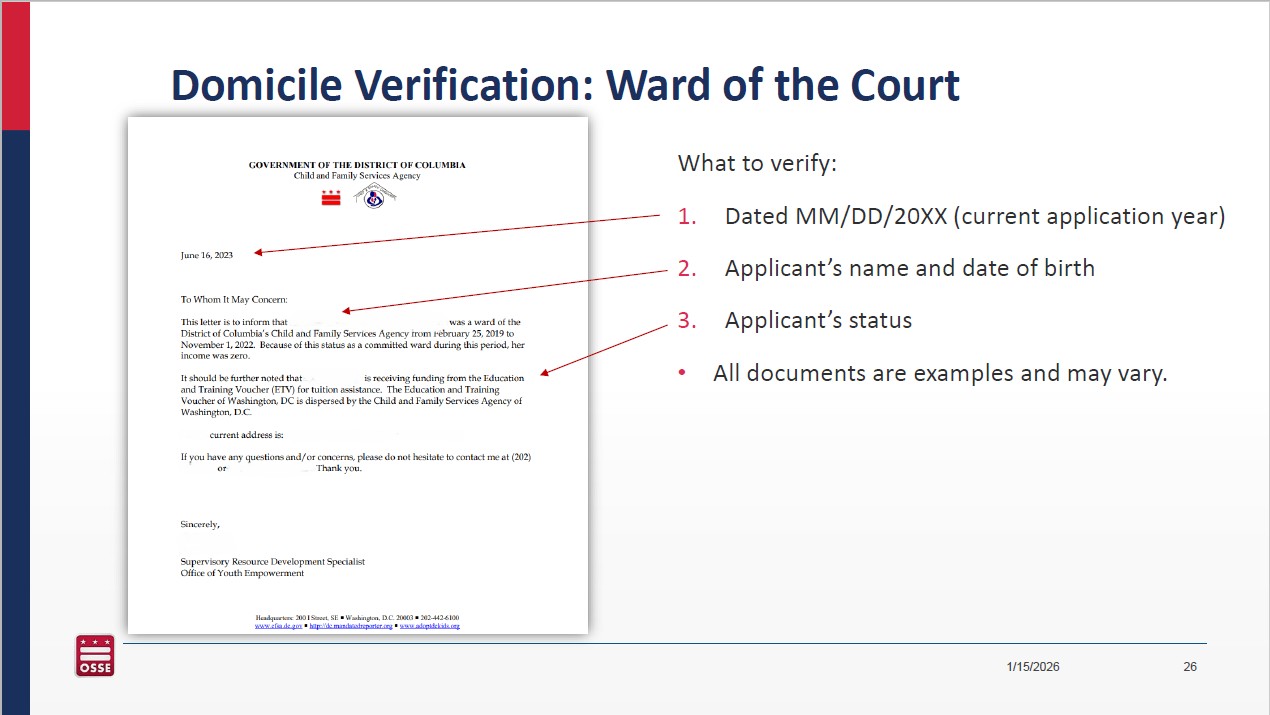

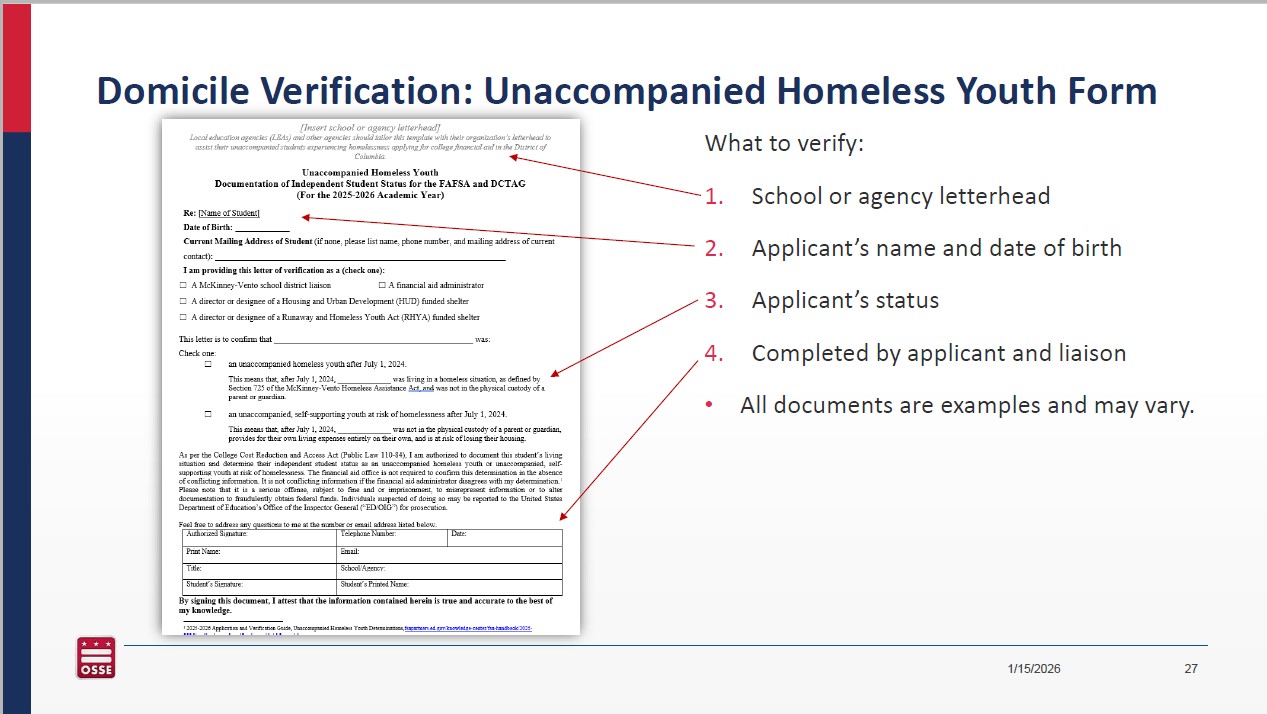

Domicile: The city, state, or country that a person treats as their permanent home. This is based on provided documentation to show proof of this claim.

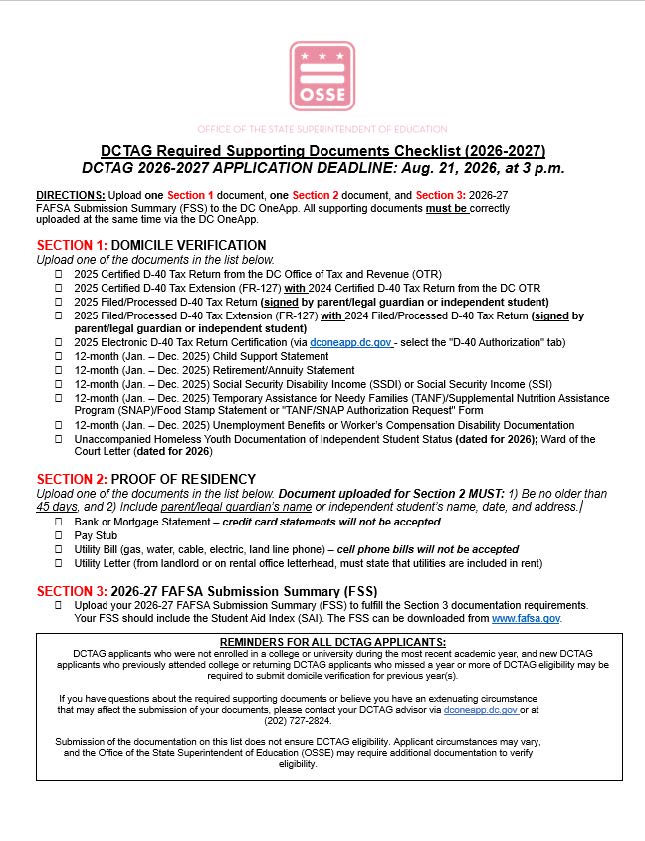

Rejected Documents: Incorrect documents that have been uploaded and need to be reviewed. After review, correct documents must be provided as one upload.

Piece mail: The process of providing all correct documents at one time when uploading. DCTAG does not accept one document at a time.

Disbursement: A payment of money, especially one made by DCTAG for an eligible student at a college or university.

Correspondence: Communication by exchanging letters, emails, or other messages. Deadline: A date or time before which the completion of the DCTAG application process must be done.

SSI: Social Security Income.